Hedging An Altcoin Portfolio Using Index Futures

--

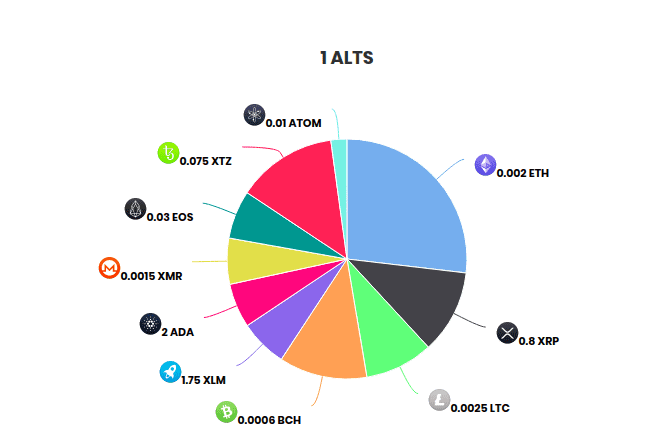

Let’s say you hold the altcoin portfolio pictured above.

Now let’s say you want to hedge this portfolio. Maybe you believe the altcoin market will drop temporarily. Maybe you don’t want to take any risk for a few weeks.

How do you hedge?

In this article, we’ll cover three ways:

- Hedging with stablecoins

- Hedging by shorting inverse futures

- Hedging by going long on an inverse index future

Hedging with stablecoins

With this method, you simply convert all of your altcoins to stablecoins.

Once you want to exit the hedge, you buy back your entire altcoin portfolio.

Your portfolio value stays the same during the hedge.

There is one significant drawback to this:

You have to execute 16 trades (2 for each coin). Not only is this a time-consuming effort, it may also result in significant fees and slippage. You could end up a lot poorer after the hedge.

Pros:

- Extremely simple

Cons:

- Very expensive (you’re paying fees 16 times)

- Very time-consuming (you’re making 16 trades)

- May incur lots of slippage if you’re placing market orders

Hedging with 8 different inverse futures

With this method, you go short on 8 different USD-denominated futures contracts. The contracts must all be inverse contracts (very easy to achieve in crypto, as 99% of the contracts on crypto derivatives platforms are inverse).

When you go short on one of these inverse contracts with 1x leverage, the USD value of your assets (collateral + position) stays the same.

A loss on your position would be offset by a profit from your collateral rising in value.

Pro’s:

- You won’t actually have to sell your current altcoin portfolio. This can be important for tax purposes.

Cons:

- You’d have to manage one contract for each coin. That would be 8 futures contracts in total.

- You’d need to open 8 different positions. Probably at multiple exchanges (very few support all of those 8 coins).

- You’d need to manage all of those positions. Deposit margin. Make sure the leverage is right.

- You’d need to place 8 different orders. Each incurring slippage and fees.

- When you want to exit your hedge, you’d need to place another 8 orders to close the positions again.

Is there an easier way?

Hedging with a single inverse index future

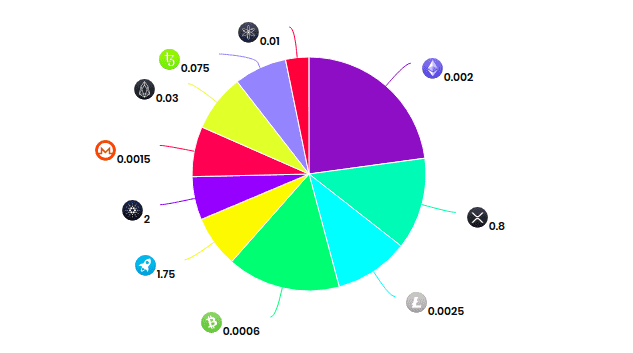

An index future is a future that incorporates multiple assets. This could be the coins seen above.

The payout of the index future is correlated to the performance of these assets as a whole.

Let’s make up an index as an example. We’ll call it ETH_80.

The point of the index is that it consists of 80% ETH and 20% something else.

Now imagine an index future, ETH_80_20, that is quoted in terms of this index.

If ETH drops to 0 USD tomorrow, the price of the index future will drop by 80%.

Inverse index futures

If the future is inverse, the price of the future will instead rise by 80%.

Inverse futures are the norm in the crypto world — you rarely ever see any linear futures. There are many reasons for this, but one, very important reason, is that inverse futures are much better for hedging than linear futures.

As we explored earlier, going short on an USD-denominated inverse future with 1x leverage will maintain the USD value of the position. You cannot gain or lose on such position. It is perfectly hedged.

Using an inverse index future, it is possible to achieve a perfect hedge for your entire altcoin portfolio — no matter how much the price of any of the coins in your portfolio moves — the combined value of your position and portfolio will always be the same.

Any losses on the USD value of your portfolio will be offset by gains on the future, and any losses on the future will be offset by gains on the portfolio.

Requirements for the perfect hedge

To achieve the perfect hedge, you’d need to ensure three things:

- The contract has to have a stablecoin as its base asset. The stablecoin could be USDT, UDSC, TUSD, DAI or any stablecoin you believe will maintain its value of $1.

- The futures contract must be quoted in an index that reflects your current portfolio. If your current altcoin portfolio is ETH and XRP, the futures contract must be quoted in an index that consists of ETH and XRP only.

- The quantities in the index must align with the quantities in your portfolio. If your portfolio is 20% ETH, the index must also be 20% ETH. If this is not the case, you may still achieve a hedge, but it won’t be a perfect hedge.

You can most likely find futures contracts that fulfill the first requirement. The second and third requirements will be harder, and you may need to settle for a (less than perfect) hedge.

Achieving the perfect hedge

Once you have found a contract that fits, you must go long on the contract. By going long on an inverse index future, you essentially go long on the base asset, as compared to the index.

This means that you believe that USDT will rise in value compared to the index, or, conversely, that the index will drop in value compared to USDT.

It can be a little confusing. For simplicity, just keep the following in mind:

- Going long means that you think the index will drop

- Going short means that you think the index will rise in value

Because the index is aligned with your altcoin portfolio, going long provides you with a hedge.

If the index drops, you lose money on your portfolio. But you gain money on the futures contract.

If the index rises, you gain money on your portfolio, but lose money on the futures contract.

When you add the losses/gains from your altcoin portfolio with the losses/gains from your futures contract, your net USD payout will always be the same. In other words, you will always maintain the same value of USD — no matter what happens to the price of the coins in your altcoin portfolio.

Your profit (and loss) will always be $0.

Pro’s:

- You only have to manage one position

- You only have to make two trades

- It’s much less time-consuming and much less expensive in terms of fees and slippage than the previous solutions

Con’s:

- You’d need to find an index future that somewhat mirrors your current portfolio.

Conclusion

An index future achieves nothing that you cannot achieve by shorting regular inverse futures, or by using stablecoins. But it does make the hedging process significantly easier.

- You only have to manage a single position

- You only have to place a single order when you open and close the hedge

- It is much, much less time-consuming and much less expensive (less fees and slippage)

If you only have a few coins in your altcoin portfolio, you should likely just convert to stablecoins, or go short on a few inverse contracts.

If you have 5 or more coins, you’d likely be better off using an index future.